The Dip - Layer 2 NFTs (It’s Not What You Think), Meme Coin Revives Solana Ecosystem, and Basic Web3 Wallet Security | Issue #4

A Look into This Week's Latest Crypto and Tech News

Layer 2 NFTs (It’s Not What You Think)

Layer 2 NFTs have been a trending topic in the NFT space over the last few weeks, acting as a driving force behind projects like Mutant Hound Collars, 10KTF (before them being acquired by Yuga), and even Renga (this one is a little more speculative than the others). This is not to be confused with Layer 2’s such as Polygon, Immutable X, etc., which is a lot of people’s initial thought. Let’s dive into the differences.

The version of Layer 2 NFTs I’m covering today consists of projects building on top of existing projects’ base layer. At the moment, the primary project being built on is BAYC, with the project most known for doing this being Mutant Hound Collars. However, this is not limited to any project and can be done in various ways. Nonetheless, I will use Mutant Hounds as an example for this section.

When you enter the Mutant Hounds website, you'll see that it is heavily inspired by MAYC, which is where things get interesting. When scrolling down, you’ll see the following banner, correlating with my explanation of projects “building on top of existing projects’ base layer.”

So for context, from what we currently know, there are no official ties between Mutant Hounds and Yuga Labs/BAYC. However, they are creating their own storyline on the base layer of MAYC intellectual property, defining a new category for the NFT industry. Although there are no official ties, Mutant Hounds has received support from the BAYC founders, furthering its credibility.

This is the thesis of web3, decentralization, and true ownership playing out in full force. We’re conscious of this monumental undertaking, and we hope to become a guide for the “Layer 3” and beyond

- lior.eth (Mutant Hounds Founder)

I wouldn’t be surprised if we see a wave of projects start to bandwagon this idea, seeing as speculation runs rampant off the hope of a Yuga Labs acquisition/integration. If anything, I can see Mutant Hounds having a lot of potential in the Otherside, acting as a “companion” for MAYC. However, that is all speculation, and buying any of these “Layer 2” NFTs in the hope of an acquisition/integration play is an insane gamble. Have fun and be safe!

Meme Coin Revives Solana Ecosystem

$BONK is a Solana-based dog-inspired meme coin that has taken the Solana community by storm over the last few days. The thesis beyond $BONK is to be the catalyst that transfers power back to the people of the Solana community, flipping the VC-dominated landscape on its head. Some say $BONK is the sole reason for Solana’s recent ~40% pump, and it’s hard to disagree. Let’s dive in.

Bonk is the first Solana dog coin for the people, by the people with 50% of the total supply airdropped to the Solana community. The Bonk contributors were tired of toxic “Alameda” tokenomics and wanted to make a fun memecoin where everyone gets a fair shot

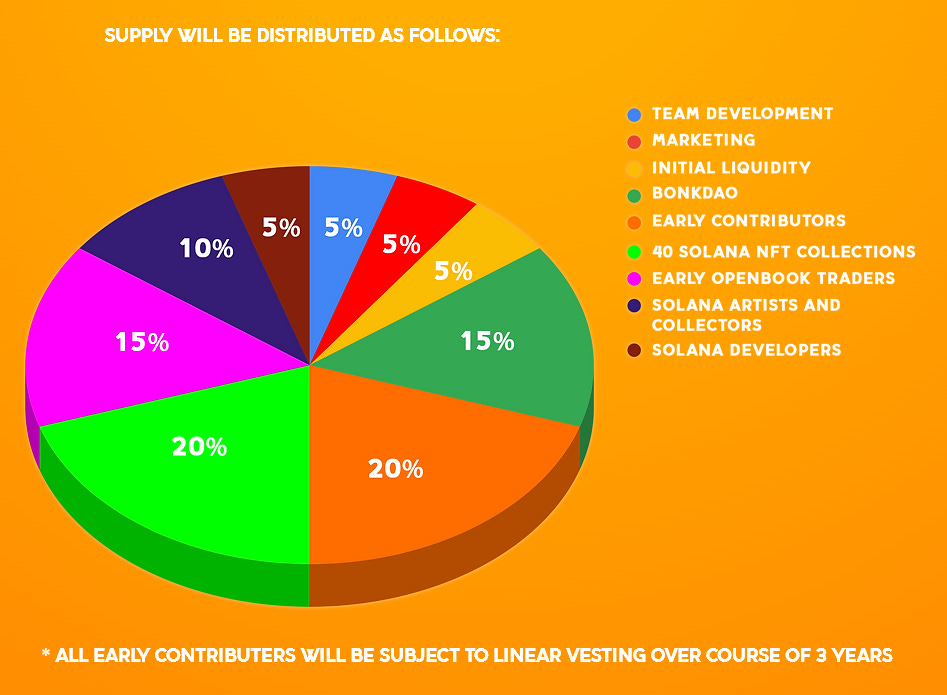

First, some context. $BONK went live in late December with a starting price of $0.0000001078. 50% of its 100 trillion total supply was dropped to Solana-based developers, artists, creators, and defi/NFT degens (traders). The following is a visual breakdown, which you can check out on their official site.

At the time of initial distribution, Solana's $SOL was trading roughly around $9.10 after putting in a new relative low of $8 earlier that day. As you would assume, the morale of the Solana community was at all-time lows across all sectors. Developers were reporting they no longer had funding for development, trading activity across Solana-based Defi projects had dried up, and 1/1 artist and traders within the NFT space had gotten rekt due to a massive exit of liquidity. However, this is when things start to get interesting.

In the days following the $BONK drop, $BONK started gaining traction on Twitter and within Solana-based Discord communities. For those that don’t know, Solana is home to some of the most degenerate degens in the entire space, so you can imagine the shilling within these communities went rampant. Even for those not highly integrated into the Solana community, it was almost impossible not to see any mention of $BONK across social platforms. For example, there was a minimum 48-hour period where my feed was FLOODED with comments on this new and upcoming meme-community coin, single-handedly reviving the Solana community. I looked, I laughed, and I moved on. Only to later find out the Solana community would be the one (currently) having the last laugh.

At the time of writing, $BONK is $0.00000316, ~30x its initial starting price. Yesterday, Jan 4th, $BONK hit an all-time high of 0.00000439, ~44x its initial starting price. As you can imagine, this inflow of liquidity is a MAJOR push in the right direction for the Solana community and is the first ray of hope shown since the FTX collapse. In all honesty, the FTX collapse was probably the best thing to happen for the Solana community, seeing as the VCs plaguing the networks are now exposed. My thoughts can be further supported by the following tweet from Vitalik Buterin, expressing that Solana now has a “bright future” ahead of it.

Regardless of how you feel about meme coins, Solana, etc., it's incredible to see an entire community rally behind the message of supporting each other. Yes, many of those who received $BONK have sold off and cashed in the profit, but that was the point, no? Nonetheless, Goodluck to the Solana community, and I’m very excited to see how $BONK affects the ecosystem moving forward.

Basic Web3 Wallet Security

For context, I’m no security expert, but I am self-teaching and going to school for cybersecurity. Therefore, I will continue sharing my thoughts and findings on various security topics, such as the one below.

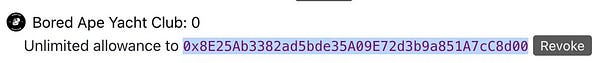

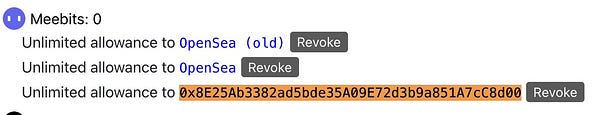

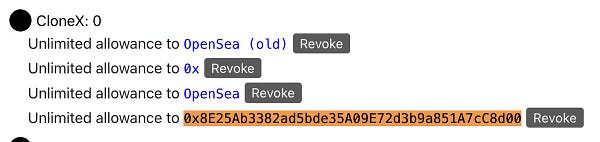

On Monday, Jan 3rd, CryptoNovo311, a known figure in the NFT/Web3 community and former employee at Vayner3, was compromised due to a signed allowance that allowed the bad actor to clean his wallet, as shown below.

This is incredibly unfortunate, and I hope that CryptoNovo311 is made whole one day. Nonetheless, this is a great time to emphasize the importance of wallet security. The following is a short and sweet wallet security structure that anyone can set up. Let me know if you have any thoughts, opinions, etc.

Use a hardware wallet.

A hardware wallet is just the tip of the iceberg but is essential for wallet security. It doesn’t completely remove the chance of being compromised, but it does mitigate the chance because it is separate from external software such as browsers, sketchy links, etc.

Simple wallet structure:

Burner wallet - This is the wallet you can use to interact with any mint sites, random applications, or anything untrusted (not that you should interact with anything untrusted, but if you have to/are curious, this is the wallet). Make sure not to hold anything of value in this besides maybe a few dollars in eth for gas fees if needed.

Trading Wallet - This wallet will trade and interact with trusted sites, such as OpenSea, Blur, etc.

Vault - This is the wallet you send NFTs or crypto that you are NOT planning on touching for an extended period (even NFTs that you purchase with the trading wallet). Do not do anything with this wallet; use it purely to receive and occasionally send items. The purpose of a vault is for it to be completely unconnected and entirely cold cut from external sites and applications.

Bank Vault - This is the holy grail wallet for NFTs you deem are forever holds. For example, BAYC, Azuki, Punks, etc., should 100% be segregated from other wallets.

Crypto Wallet - This wallet will hold most of your ERC-20 coins. Yes, the previously listed wallets will need ETH for sending and transactional purposes, but separating the majority is good practice for keeping your liquidity secure.

Mobile Wallet - This wallet will be used for “on the fly” purposes. Quick buys, time-sensitive mints, etc. It’s best to treat this wallet as a burner and hold only enough ETH for minting and transactional purposes.

This wallet segregation structure is a great starting point for security upkeep. When dispursing assets like this, you significantly mitigate the risk of your entire portfolio getting cleaned. Even if wallets are stored on the same device (software wallet, hardware wallet, etc.), one wallet being compromised does not affect the other because each wallet’s contract is unique and separate.

I hope you learned something. Thank you for your time <3